Welcome to Superior Commercial Contracting!

Superior specializes in Commercial Contracting and Restoration claim management after wind & hail storms for both Commercial and now Residential properties.

Superior is here to support you! Your insurance provider will pay Superior to manage all of the work at your property. If you already have a local subcontractor like a roofer, GREAT! Superior will manage the rest. We will make sure you are protected and we make sure that the insurer pays for all of the work.

NEVER SIGN AN ABO CONTRACT!

*Superior does not ask you to sign any contracts taking the claim out of your hands. We do not think our customers should ever sign an ABO “Assignment of Benefits” CONTRACT.

About Superior

Superior opened it doors in 1994. In the 26+ years since, we have completed some of the highest profile restoration projects in the country including the largest hotel in New Orleans “ Hyatt Regency 601 Loyola Ave” and “Ocean Key Resort & Spa located at the end of the key west 0 Duval street”. We have renovated over 260 high end resorts and hotels. Superior specializes in difficult projects most contracts will not touch. These include Highrise buildings over 361 feet tall, Military bases and large hospitals. Superior has recently included residential restoration for complicated structures due to the amount of devastation in our local community.

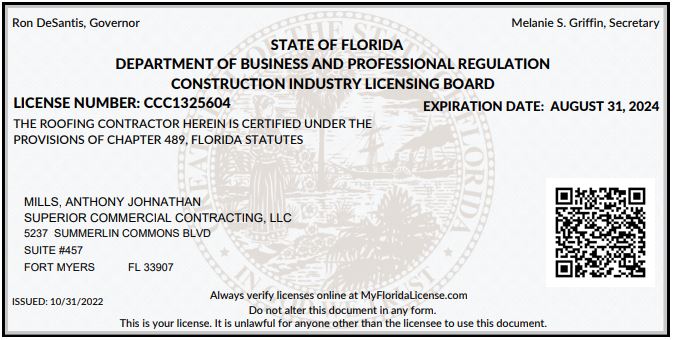

Contractor Verification!

Confirming that a contractor is locally licensed, and insured should be your first priority. We have made it easy.

Why choose Superior as your Contractor?

Insurance providers trust Superior

Insurance providers trust Superior. We work with both building owners and insurers. Everyone knows that residential storm-chasing contractors have a bad reputation for a good reason. Storm Chasers know how to game the insurance system. They also know how to pray on building owners promising big payouts. Superior has a team of experts that understand how to hold the insurers accountable for paying the real cost of the claim without price gouging or using shady tactics.

What makes Superior different?

Superior gets paid a percentage of the project for all the work by your Insurance provider. It does not matter if the work is completed by your subcontractor or one of our preferred subcontractors. Our goal is to create the best experience possible during this difficult time. We will confirm that the claim has been handled correctly from the start.

Let's Start

Contact Us Today

So We Can Begin Keeping You Covered!

What Our Customers Have To Say

We Put Our Customers First And Are Proud To Serve.

STOP WASTING MONEY INSTALLING BLUE TARPS. WE WILL PROVIDE A ONE YEAR ROOF WARRANTY WITH OUR SHRINK WRAP SYSTEM!

Protect your investment with a long term solution!

Superior will install a 12 mil fire retardant structural wrap that will heat shrink to your roof providing water protection for the next 12 months.

OUR WORK

Companies we work with

What you should expect from Superior!

empty

1. We will confirm the damage has been properly identified.

2. Understand what coverages you have!

3. Confirm compliance with current building codes.

Building codes require structures to be built to certain minimum standards. We will confirm whether your home meets current standards and whether the repair or replacement will require upgrades.

4. Confirm that the Contractor’s and Insurer’s scope of work for repairs or replacement meets the needs of all damage including structural damage.

You should not assume that the contractor giving you a price for repair or replacement has included structural repairs or needed code upgrades. In many cases, the subcontractor performing the work may not have the license or manpower to correct structural issues.

5. Work with your insurer and the subcontractors to confirm pricing.

Our team of experts uses the same estimating program that your insurer used to estimate the money you should receive for the claim. If a pricing issue occurs, we understand how to explain the cost difference to your insured. On the other side of the coin, we know if the subcontractor is trying to take advantage of you and your insurer.

6. Supplements and change orders.

It is typical that a contractor will find unseen repairs needed during the construction of the project. The Contractor will bill you extra for this work. Some contractors will underbid a project to get the project awarded to them. They know that after you sign a contract with them, they can make up the money not included in their original bid by charging you extra money with change order requests. Your insurer will push back on any change orders not properly documented and accounted for. That can result in you having to pay out of pocket. Controlling the cost of the job by managing change orders and supplements is probably our biggest value to our customers.

7. Quality Control – We confirm that the subcontractors have installed what they said they would install. We also confirm that it meets or exceeds Building Code requirements and the manufacturer's requirements for warranty.

8. Warranty and Lien Release.

Superior is a locally operated full service General Contractor specializing in commercial and residential storm damage restoration. Superior’s head project manager for the Fort Myers area has extensive insurance background, and is a former commercial insurance adjuster with HAAG certification. Superior has over $7,000,000.00 in liability insurance and $1,000,000.00 in workers comp insurance. Due to the storm location, Superior is also helping homeowners. We understand that most homeowners do not understand how to negotiate with the insurance companies. We do!

Why would your insurance company pay for you to have a General Contractor manage your project!

Most Insurers understand that building owners need help with large loss projects.

Insurers know that it is not reasonable for a building owner to play the role of a general contractor. Most building owners do not know building codes, State and City licensing requirements, Material specifications, how to qualify subcontractors, determine whether they can do the work for the settlement price, making sure they pull the permits, and finally ensure that their work was done in acceptable workmanship manner, and according to building codes.

Most owners would prefer a licensed contractor help them and provide an additional layer of security, piece of mind, and supervision over the work. By using a General Contractor to coordinate the work between the various trades, you avoid wasted time and effort trying to research play the roll of the General Contractor.

After a disaster, you want to get back to normal as soon as possible, and your insurance company wants that too!

Your Insurer will not pay you to be the General Contractor, but they will pay Superior to oversee your project. You can choose your own roofer, framer, painter or use one of our preferred subcontractors.

How to verify a contractor!

It is always suggested to look online at the company’s website, reviews, and BBB rating. Unfortunately, these results can be manipulated by paying money to boost how a contractor looks online. Superior has worked with the city to provide information on how you can verify what really matters online.

Superior has been working with the city on the following community alert

UNLICENSED CONTRACTOR PERFORMING WORK DUE TO STORM DAMAGE!

Due to a large amount of damage caused by hurricane Ian on September 28th, several unlicensed contractors have come into Florida. Several complaints have been filed regarding STORM CHASING CONTRACTORS posing as licensed General Contractors offering free roofs. Many Florida homeowners have been pressured into signing unlawful contracts from unlicensed contractors going door to door.

Homeowners are asked to “DO YOUR HOMEWORK”!

blank

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

1. CONTRACTORS LICENSE

Ask for a copy of the contractor’s STATE ISSUED CONTRACTORS LICENSE!

Florida has several types of contracting licenses: General Contractor, Building Contractor, and Residential Contractor. Each licenses several limitations regarding the height, size, and use of a building or home. License requires the passing of a state test, background checks, minimum insurance requirements, and yearly financial reviews.

To lookup if a contractor has an active license, go to: https://www.myfloridalicense.com/wl11.asp

You will need the name of the license holder or license number.

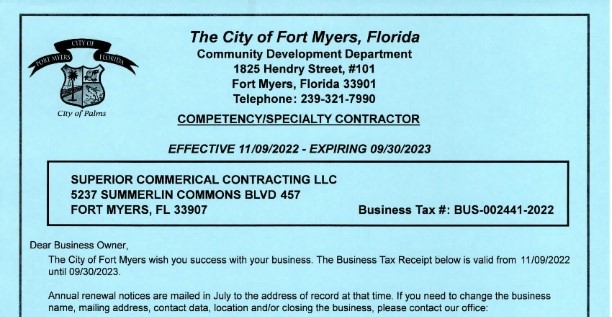

2. SPECIALTY LICENSE

Depending on the work required, a specialty license is required. A roofing license is required to repair or replace your roof.

To lookup if a contractor has an active license, go to: https://www.myfloridalicense.com/wl11.asp

You will need the name of the license holder or license number.

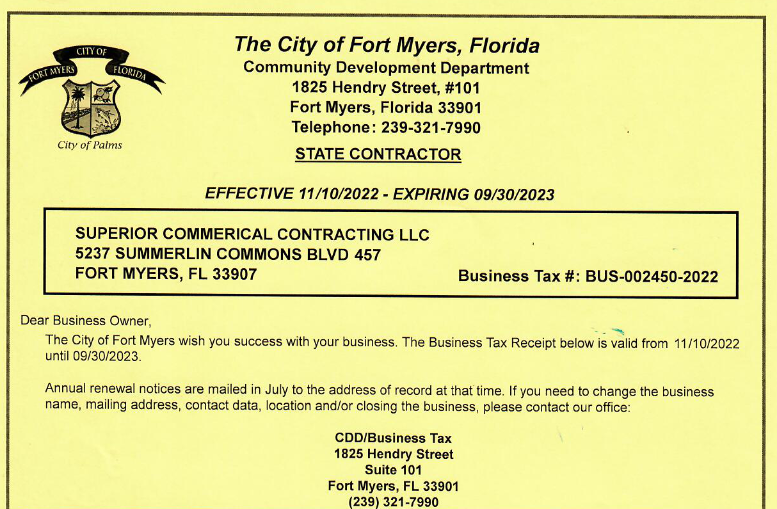

3. City License

Every contractor is required to register with the city they are doing work in. Each City has different requirements. You should ask what city their office is located. You should see two certificates. One from the city they operate in and your city that they want to work in. To lookup if a contractor has an active license in your city, go to your city’s website:

Fort Myers:

Coral Gables:

4. Ask for proof of insurance!

If the contractor cannot provide all of the above documents, they should be disqualified from bidding on your project!

What Superior cannot do!

Superior is a licensed General Contractor that understands project management, building codes, and the proper execution of work to subcontractors. Superior is not a public insurance adjuster. Superior and/or any contractor is not allowed interpret policy provisions or advise you regarding coverages or duties of your insurer under your policy. A contractor may not induce or encourage you to make an insurance claim. A contractor cannot offer you a rebate, gift, gift card, cash, coupon, or waiver of any insurance deductible. If anyone from Superior has made any claims or representations regarding the above, please contact our office at 732-222-2222 and report them. Superior assumes you have obvious damage from hurricane Ian and are looking for a general contractor to manage the process of getting your property repaired. If you need guidance regarding your policy, Superior can recommend one of the following:

1. Public insurance adjuster is a licensed and bonded insurance professional who assists policyholders with the complicated insurance claim process when they suffer an insured loss. They are also known as a “PA”. They do charge a fee for their service that is typically not covered by your insurer.

2. Insurance Claim Lawyer – Hiring a lawyer becomes essential in cases where there is a huge claim amount, when the fault is difficult to establish or when there is a huge difference in the amount you want and your insurer’s quotes. They do charge a fee for their service that is typically not covered by your insurer.

Who Our Service is not designed for!

Our service is intended to help Commercial and Residential owners that have large difficult projects with obvious damage from hurricane Ian. Homeowners with small amounts of damage to shingle roofs do not need our service. Most properties with no structural damage that only require a shingle roof replacement may not qualify for the use of a General Contractor by your insurer. We are happy to meet with anyone concerned about the amount of damage they may have. About half of the buildings, we inspect meet our requirements for service.

What we expect from you!

If your building meets the needed requirements for Superior to help manage the restoration of your property, we will offer you our service with a service agreement. That agreement authorizes Superior to provide “Contractor Services" in the form of property inspections, photos, estimates, satellite imagery, and other research related to the property. Superior will meet third party (insurance carrier, warranty, mortgage, or other) and provide necessary findings regarding deficiencies to property, structures, and building materials, as related to weather, workmanship, or warranties. Superior will work with your preferred

specialty contractors our utilize our preferred subcontractors to collect qualified scopes of work need to complete a full restoration of your property.

Upon the work being approved and funded by the third party, the Property Owner and Superior shall enter into a formal building contract to begin repairs for the approved price as paid by the third party, and within 30 days of payment being issued to Property Owner.

*Please note that our agreement does not assign your benefits to Superior. This is known as an AOB

“Assignment of Benefits”. You are in full control of what subcontractors you want to use and what work you want completed.

Superior will provide you with a copy of our state contractors license, a copy of our local license to work in your city, a certificate of insurance listing you as additionally insured, and a copy of any specialty licenses needed to complete the work before asking you to sign our contract.

Transparency and Integrity!

You will receive a personalized online portal that allows you to see all of the communications regarding your project. This includes photos, subcontractor quotes, permits, reports and a line-item accounting of all work expected to be completed. You can communicate directly with your project supervisor and use our calendar to let the team know your availability.

Properly documenting your claim is our priority. If you feel overwhelmed by the claims process, we can help guide you through the process and provide the needed tools to keep up with any requirements your insurer has.

How long will it take to restore my property?

It can take between 6 months and 2 years before your work is completed!

Material Shortages

If you have a large, complicated project, you are looking at a minimum of six months to get materials. Before the storm, commercial and tile customers had a 4 to 6 month wait. Tile, TPO, ISO and many other commercial materials have been on back order for moths. This storm will only add to that delay.

Insurance Adjuster delays

Most insurance companies do not have the manpower to properly inspect everyone’s property quickly. The first person to inspect your damage may not have been qualified to properly inspect the damage. If you have a large commercial building or a large home with tile, your building may require a number of inspections before the insurer agrees on what damage they will cover.

How do you keep your roof watertight until your new roof can be installed?

Blue tarps are a quick short-term fix. Tarps do not last more that six to eight weeks. Blue tarps are not a good long term solution for commercial or tile roofs.

White TPO or Shrink wraps system last over a year and can be repaired without have to replace all the material. It will cost more upfront but will same you money in the end.